From our medium blog post published at: https://medium.com/@datadrivenlab/blockchain-energy-consumption-debunking-the-misperceptions-of-bitcoins-and-blockchain-s-climate-61ac57bc0709

Launched in 2009, Bitcoin was the first application of blockchain or distributed ledger technologies (DLTs) more broadly. Since then, both Bitcoin and blockchain have matured tremendously. Bitcoin is now a US$ 920 B financial network, and blockchain is hailed as a radically innovative technology that is set to disrupt how we govern data and exchange value in a transparent and decentralized way. These new bottom-up and decentralized blockchain designs are desperately needed to overcome current legacy system thinking and path dependence to incentivize collaboration for major change and enable digital democracy for the Paris Agreement and climate action more broadly.

Unfortunately, blockchain is still frequently perceived and used as a blanket term synonymous with bitcoin rather than a broad group of diverse technologies. It is like using the Internet when you really want to refer to a specific application like Facebook, Amazon, Netflix, or Google — they are all based on the same infrastructure (i.e., the Internet). Still, they have very different use cases and designs. Similarly, the use of blockchain as a uniform term and the confusion surrounding blockchain and Bitcoin causes public misperceptions, miseducation, and general uncertainty regarding blockchain technology.

For example, critics are quick to raise questions about blockchain’s potential negative implications for climate change due to the high energy consumption of Bitcoin, despite the technology’s significant potential to accelerate climate action. Examples of how blockchain can support and accelerate climate action are Yale Openlab’s OpenClimate, the World Bank Climate Warehouse, the Blockchain for Climate Foundation, the Climate Ledger Initiative, and the Climate Chain Coalition, amongst others.

Blockchain’s energy consumption currently receives a lot of attention while unfortunately being frequently misunderstood. Given the Data-Driven EnviroLab’s (DDL) and the Open Earth Foundation’s (OEF) ongoing research that investigates the potential for blockchain to improve climate action accounting, we want to set the record straight on blockchain’s real energy consumption and resulting climate implications and clarify the most prevalent misconceptions.

First, Bitcoin’s high energy consumption is almost exclusively inherent to the Bitcoin network due to its architectural and governance design choices. High energy consumption is not intrinsic to blockchain technology in general, particularly not to the technology architectures that DDL and OEF are developing. The amount of energy consumed by a blockchain or cryptocurrency network depends on its consensus mechanism, determining what information is added to the network ledger.

Proof-of-Work and Bitcoin overview

Proof-of-Work (PoW) is the consensus mechanism first popularized for permissionless blockchains and cryptocurrencies through the Bitcoin network. This PoW network is run by validators, so-called miners, who add new blocks of transactions to the network on an ongoing basis. As a reward, these miners receive incentives in the form of block rewards (a fixed amount that is predetermined) and transaction fees (paid by each user conducting a transaction).

Bitcoin’s PoW miners compete for these incentives by adding computational power to the network; the more computational power, the higher the chance to receive the incentive. Specialized PoW mining hardware devices generate computational power, so-called ASIC miners, which consume vast amounts of energy in the process. Accordingly, Bitcoin’s PoW miners are incentivized to add more and more computational power to the network, consuming more and more energy. However, the growing energy consumption is not as bad as it initially sounds and is frequently portrayed.

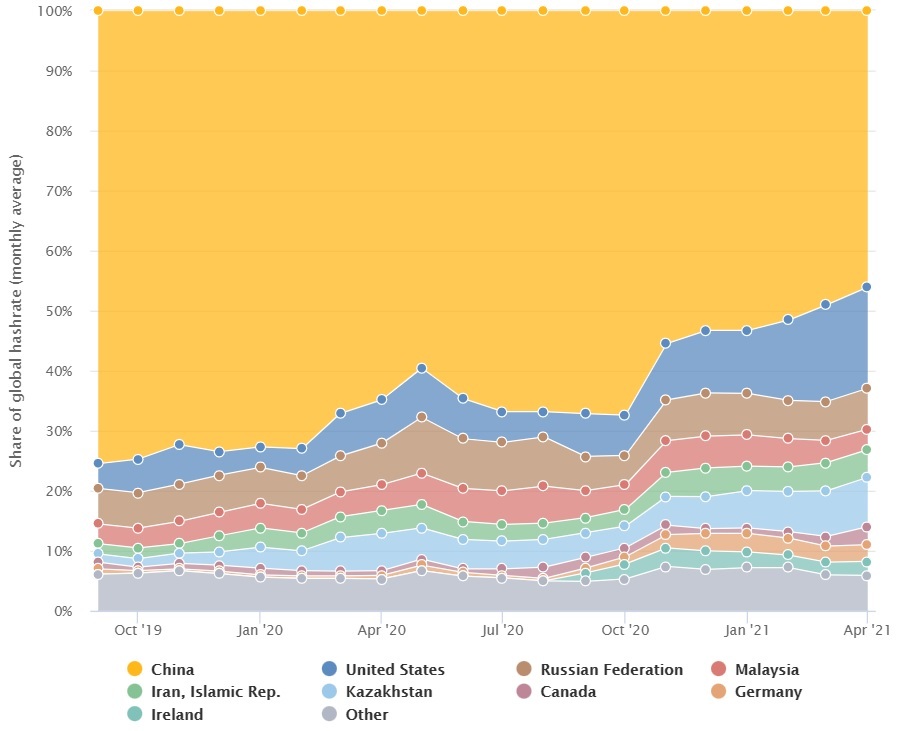

As miners are not confined to a specific location but can plug into the Bitcoin network from every place in the world with a sufficient internet connection, PoW miners have been gravitating to regions with higher shares of renewable energy (table 1 & figure 1). This trend is likely to accelerate over time based on renewable energy sources becoming increasingly cost-competitive and often cheaper than burning fossil fuel. Another central turning point is the recent Chinese ban of all cryptocurrency mining, which has pushed approximately 50 percent of China’s mining power to relocate to new regions. This relocation substantially reduces Bitcoin-related climate impact as the miners move away from the coal-based Chinese grids into regions with higher renewable energy shares, leading to the retirement of old and inefficient mining equipment.

In addition, other research shows that Bitcoin mining can even be used as a “subsidy” for renewable energy, as it can use energy during times of excess generation. Monetizing this excess generation through PoW mining creates returns that further improve the business model of renewable energy sources (see e.g., Square 2021 or ARKinvest 2021 for additional information).

Other consensus mechanisms like Proof-of-Stake

But we can’t allow Bitcoin and PoW mining’s potential heavy energy consumption to sidetrack blockchain’s potential upsides — again; high energy consumption is only inherent to Bitcoin (and other PoW Cryptocurrencies to a minor degree). It does not apply to most other blockchain architecture designs. There are already many other consensus mechanisms that have already been developed and keep on evolving.

For example, Ethereum, the second-biggest cryptocurrency, is currently transitioning its consensus mechanisms from PoW to Proof-of-Stake (PoS). In PoS, network validators — which fulfill a similar function to miners in Bitcoin — support the network by putting up a token stake to determine which transactions are added as blocks to the blockchain.

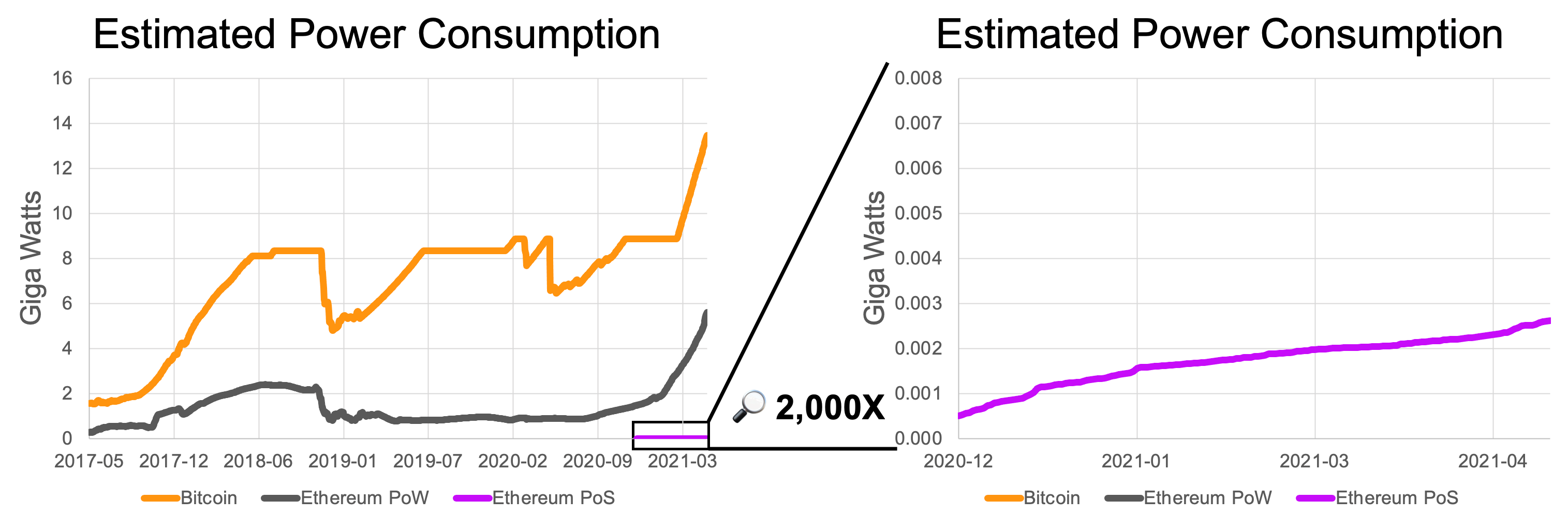

As the PoS validators are not competing through computational power, which consumes energy, running these validator nodes only requires economic resources like network tokens. Except for the comparatively minimal amounts of energy to run the distributed network nodes, no additional energy. According to the Ethereum Foundation, the transition from PoW to PoS reduces the Ethereum total network’s energy consumption by at least 99.95% (figure 2), or 2.62 megawatts equivalent to a small town of around 2,100 American homes.

This comparison is not to impose any value judgment on the Bitcoin or Ethereum networks but to illustrate that the design of the consensus mechanism determines energy consumption. A substantial number of consensus mechanisms already exist that keeps growing (see, for example, Wang et al., 2019 and Shahaab et al., 2019). These mechanisms have different design specifications relating to network governance and authority distribution, reflecting trade-offs between network decentralization, scalability, and security. Due to these trade-offs, blockchains have specific strengths and limitations that must be carefully matched with the respective use case requirements.

DDL’s & OEF’s blockchain design approaches

At DDL and OEF, our goal is to use blockchain technology to create a distributed network design that enhances transparency and reduces information asymmetries among heterogeneous climate actors. This design is based on bottom-up data contributions from all actors to allow for the triangulation of independent data sources. Consequently, we are opting for a blockchain design that does not consume significantly and differs from cryptocurrency applications.

We generally use consensus mechanisms that are run by known and verified entities acting as validators. These validators have shared ownership of the blockchain system and are actors like national governments, intergovernmental organizations, independent verifiers, academia, and non-profits. Accordingly, the validators are incentivized based on reputation and accountability, given that their identity is known to everyone and appointed or elected by the broader climate community. This design represents just a high-level description to illustrate the difference to the PoW and PoS consensus mechanism logics. The actual governance of network validators is highly complex and will be developed by the community over time.

An example of such a climate use case application is the World Bank Climate Warehouse, which uses the Proof-of-Authority (PoA) consensus mechanism. The Warehouse links diverse climate accounting systems into a shared blockchain-based platform that aggregates and harmonizes all climate accounting data. PoA is a permissioned fork, i.e., copy of code, of the Ethereum protocol where the different network participants run the network validation node. In this way, all the network participants “own” a copy of the network for maintaining their sovereignty and can directly contribute to their transactions while also having real-time oversight of the transactions of all other actors. If an actor tries to collude, the network can identify such collusion attempts and take appropriate action by, e.g., revoking the validator status.

The shared consensus among the climate community is a deliberate design choice, as this design requires all actors to verify their data and report their emissions transparently. Holding national, subnational, and non-state actors accountable is essential for achieving the climate goals as set out in the Paris Agreement (see, e.g. (Pauw & Klein 2020), (Schoenefeld et al., 2018), and (Winkler et al., 2017) for more information). Also, Greta Thunberg calling out the UK for lying about cutting their emissions presents another recent example of why we need alternative data governance structures to ensure the validity and accuracy of critical emissions data.

Stay tuned on our Medium channel, our Data-Driven EnviroLab and Open Earth Foundation homepages, and our new Climate Data 2.0 Wikisite for updates. For additional reading, see the below list of relevant literature.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — —

APPENDIX — List of Bitcoin energy consumption publications

Agung, A. A. G., Dillak, R. G., Suchendra, D. R., & Robbi, H. (2019). Proof of work: Energy inefficiency and profitability. Journal of Theoretical and Applied Information Technology, 97(5), 1623–1633.

ARKinvest. (2021). SolarBatteryBitcoin. 1–6. Retrieved from https://github.com/ARKInvest/SolarBatteryBitcoin

Aste, T. (2016). The Fair Cost of Bitcoin Proof of Work. SSRN Electronic Journal, 0–2. https://doi.org/10.2139/ssrn.2801048

Auer, R. (2019). Beyond the Doomsday Economics of “Proof-of-Work” in Cryptocurrencies. Federal Reserve Bank of Dallas, Globalization Institute Working Papers, 2019(355). https://doi.org/10.24149/gwp355

Benetton, M., Compiani, G., & Morse, A. (2019). CryptoMining: Energy Use and Local Impact.

Blandin, A., Pieters, G. C., Wu, Y., Dek, A., Eisermann, T., Njoki, D., & Taylor, S. (2020). 3rd Global Cryptoasset Benchmarking Study. SSRN Electronic Journal, (September). https://doi.org/10.2139/ssrn.3700822

Carter, N. (2021). The Bitcoin Energy Debate us a Modern Reprise of the Gold Resource Cost Debate. Bitcoin Magazine. Retrieved from https://bitcoinmagazine.com/culture/bitcoin-and-gold-energy-debate

Carter, N. (2021). What Bloomberg Gets Wrong About Bitcoin’s Climate Footprint. CoinDesk, 1–14. Retrieved from https://www.coindesk.com/what-bloomberg-gets-wrong-about-bitcoins-climate-footprint

Carter, N. (2021). The Frustrating , Maddening , All- Consuming Bitcoin Energy Debate. CoinDesk, 1–15. Retrieved from https://www.coindesk.com/frustrating-maddening-all-consuming-bitcoin-energy-debate

Carter, N. (2021). On Bitcoin, the Gray Lady Embraces Climate Lysenkoism. Medium.Com, 1–16. Retrieved from https://medium.com/@nic__carter/on-bitcoin-the-gray-lady-embraces-climate-lysenkoism-a2d31e465ec0

Carter, N. (2021). Noahbjectivity on Bitcoin Mining. A response to Noah Smith. Medium.Com, 1–17. Retrieved from https://medium.com/@nic__carter/noahbjectivity-on-bitcoin-mining-2052226310cb

Das, D., & Dutta, A. (2020). Bitcoin’s energy consumption: Is it the Achilles heel to miner’s revenue? Economics Letters, 186(xxxx), 108530. https://doi.org/10.1016/j.econlet.2019.108530

de Vries, A. (2019). Renewable Energy Will Not Solve Bitcoin’s Sustainability Problem. Joule, 3(4), 893–898. https://doi.org/10.1016/j.joule.2019.02.007

de Vries, A. (2018). Bitcoin’s Growing Energy Problem. Joule, 2(5), 801–805. https://doi.org/10.1016/j.joule.2018.04.016

Delgado-Mohatar, O., Felis-Rota, M., & Fernández-Herraiz, C. (2019). The Bitcoin mining breakdown: Is mining still profitable? Economics Letters, 184, 108492. https://doi.org/10.1016/j.econlet.2019.05.044

Dittmar, L., & Praktiknjo, A. (2019). Could Bitcoin emissions push global warming above 2 °C? Nature Climate Change, 9(9), 656–657. https://doi.org/10.1038/s41558-019-0534-5

Eigelshoven, F., Ullrich, A., & Bender, B. (2020). Public Blockchain — a Systematic Literature Review on the Sustainability of Consensus Algorithms. Twenty-Eigth European Conference on Information Systems (ECIS2020), Marrakesh, Morocco., (June), 1–17. Retrieved from https://aisel.aisnet.org/ecis2020_rp/202

Fadeyi, O., Krejcar, O., Maresova, P., Kuca, K., Brida, P., & Selamat, A. (2020). Opinions on sustainability of smart cities in the context of energy challenges posed by cryptocurrency mining. Sustainability (Switzerland), 12(1). https://doi.org/10.3390/su12010169

Gallersdörfer, U., Klaaßen, L., & Stoll, C. (2020). Energy Consumption of Cryptocurrencies Beyond Bitcoin. Joule, 4(9), 1843–1846. https://doi.org/10.1016/j.joule.2020.07.013

Giungato, P., Rana, R., Tarabella, A., & Tricase, C. (2017). Current trends in sustainability of bitcoins and related blockchain technology. Sustainability (Switzerland), 9(12). https://doi.org/10.3390/su9122214

Goodkind, A. L., Jones, B. A., & Berrens, R. P. (2020). Cryptodamages: Monetary value estimates of the air pollution and human health impacts of cryptocurrency mining. Energy Research and Social Science, 59(September 2019), 101281. https://doi.org/10.1016/j.erss.2019.101281

Greenberg, P., & Bugden, D. (2019). Energy consumption boomtowns in the United States: Community responses to a cryptocurrency boom. Energy Research and Social Science, 50(August 2018), 162–167. https://doi.org/10.1016/j.erss.2018.12.005

Halgamuge, M. N., & Syed, A. (2019). Energy Efficient Bitcoin Mining to Maximize the Mining Profit : Using Data from 119 Bitcoin Mining Hardware Setups ENERGY EFFICIENT BITCOIN MINING TO MAXIMIZE THE MINING PROFIT : USING DATA FROM 119 BITCOIN MINING. (November).

Houy, N. (2019). Rational mining limits Bitcoin emissions. Nature Climate Change, 9(9), 655. https://doi.org/10.1038/s41558-019-0533-6

Jiang, S., Li, Y., Lu, Q., Hong, Y., Guan, D., Xiong, Y., & Wang, S. (2021). Policy assessments for the carbon emission flows and sustainability of Bitcoin blockchain operation in China. Nature Communications, 12(1), 1938. https://doi.org/10.1038/s41467-021-22256-3

Kim, J. T., Jin, J., & Kim, K. (2018). A study on an energy-effective and secure consensus algorithm for private blockchain systems (PoM: Proof of Majority). 9th International Conference on Information and Communication Technology Convergence: ICT Convergence Powered by Smart Intelligence, ICTC 2018, 932–935. https://doi.org/10.1109/ICTC.2018.8539561

Koomey, J. (2019). Estimating Bitcoin Electricity Use: A Beginner’s Guide. Coin Center Report, (May). Retrieved from https://coincenter.org/files/estimating-bitcoin-electricity-use.pdf

Krause, M. J., & Tolaymat, T. (2018). Quantification of energy and carbon costs for mining cryptocurrencies. Nature Sustainability, 1(11), 711–718. https://doi.org/10.1038/s41893-018-0152-7

Küfeoglu, S., & Özkuran, M. (2019). Energy Consumption of Bitcoin Mining. Cambridge Working Papers in Economics, (December 2017).

Kugler, L. (2018). Why cryptocurrencies use so much energy — and what to do about it. Communications of the ACM, 61(7), 15–17. https://doi.org/10.1145/3213762

Leslie, M. (2020). Will Cryptocurrencies Break the Energy Bank? Engineering, 6(5), 489–490. https://doi.org/10.1016/j.eng.2020.03.011

Li, J., Li, N., Peng, J., Cui, H., & Wu, Z. (2019). Energy consumption of cryptocurrency mining: A study of electricity consumption in mining cryptocurrencies. Energy, 168, 160–168. https://doi.org/10.1016/j.energy.2018.11.046

Malfuzi, A., Mehr, A. S., Rosen, M. A., Alharthi, M., & Kurilova, A. A. (2020). Economic viability of bitcoin mining using a renewable-based SOFC power system to supply the electrical power demand. Energy, 203, 117843. https://doi.org/10.1016/j.energy.2020.117843

Masanet, E., Shehabi, A., Lei, N., Vranken, H., Koomey, J., & Malmodin, J. (2019). Implausible projections overestimate near-term Bitcoin CO2 emissions. Nature Climate Change, 9(9), 653–654. https://doi.org/10.1038/s41558-019-0535-4

Mishra, S. P., Jacob, V., & Radhakrishnan, S. (2017). Energy Consumption — Bitcoin ’ S Achilles Heel. SSRN Electronic Journal, 1–10.

Mora, C., Rollins, R. L., Taladay, K., Kantar, M. B., Chock, M. K., Shimada, M., & Franklin, E. C. (2018). Bitcoin emissions alone could push global warming above 2°C. Nature Climate Change, 8(11), 931–933. https://doi.org/10.1038/s41558-018-0321-8

Narayanan, A. (n.d.). United States Senate, Committee on Energy and Natural Resources Hearing on Energy Efficiency of Blockchain and Similar Technologies.

O’Dwyert, K. J., & Malone, D. (2014). Bitcoin mining and its energy footprint. IET Conference Publications, 2014(CP639), 280–285. https://doi.org/10.1049/cp.2014.0699

P. Wongthongtham, Morrison, G., & Liu, X. (n.d.). The Costs and Benefits of Blockchain Based Peer-to-peer Energy Trading : An Evaluation from the Perspective of Carbon Emission and Economic Value. Low Carbon Living CRC.

Rusovs, D., Jaundalders, S., & Stanka, P. (2018). Blockchain mining of cryptocurrencies as challenge and opportunity for renewable energy. 2018 IEEE 59th International Scientific Conference on Power and Electrical Engineering of Riga Technical University (RTUCON), 855, 1–5. https://doi.org/10.1109/RTUCON.2018.8659867

Saleh, F. (2018). Blockchain Without Waste: Proof-of-Stake. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3183935

Schinckus, C., Nguyen, C. P., & Ling, F. C. H. (2020). Crypto-currencies trading and energy consumption. International Journal of Energy Economics and Policy, 10(3), 355–364. https://doi.org/10.32479/ijeep.9258

Sedlmeir, J., Buhl, H. U., Fridgen, G., & Keller, R. (2020). The Energy Consumption of Blockchain Technology: Beyond Myth. Business & Information Systems Engineering, 62(6), 599–608. https://doi.org/10.1007/s12599-020-00656-x

Square. (2021). Bitcoin is Key to an Abundant , Clean Energy Future. (April), 1–5. Retrieved from https://assets.ctfassets.net/2d5q1td6cyxq/5mRjc9X5LTXFFihIlTt7QK/e7bcba47217b60423a01a357e036105e/BCEI_White_Paper.pdf

Stoll, C., Klaaßen, L., & Gallersdörfer, U. (2019). The Carbon Footprint of Bitcoin. Joule, 3(7), 1647–1661. https://doi.org/10.1016/j.joule.2019.05.012

Truby, J. (2018). Decarbonizing Bitcoin: Law and policy choices for reducing the energy consumption of Blockchain technologies and digital currencies. Energy Research and Social Science, 44(February), 399–410. https://doi.org/10.1016/j.erss.2018.06.009

Vranken, H. (2017). Sustainability of bitcoin and blockchains. Current Opinion in Environmental Sustainability, 28, 1–9. https://doi.org/10.1016/j.cosust.2017.04.011

Zade, M., Myklebost, J., Tzscheutschler, P., & Wagner, U. (2019). Is bitcoin the only problem? A scenario model for the power demand of blockchains. Frontiers in Energy Research, 7(MAR). https://doi.org/10.3389/fenrg.2019.00021

Google is still putting this six month old article first, in results for “blockchain energy consumption,” so you might want to edit a small but significant error which has presumably been there the whole time.

In the paragraph above figure 2, you say Ethereum PoS will reduce “consumption by at least 99.95% (figure 2), or 2.62 megawatts” but it will actually reduce it “by” gigawatts, “to” 2.62 megawatts, if I correctly read the estimate in the source.

Where do I get the whiteboard of this?

Amother more recent difficulty in relation to this is how to account for PoX networks which are often connected to PoW networks, but utilize parts of their systems to expand the capabilities of the intial network without a hardfork yet also may due to their mechanisms either affect or offset some of the energy used by those networks.

Another important thing to discuss would be probabily to add the comparison of the number of wallets with the number of households in the united states for bitcoins side of the operation as well as some stats such as cost of lighting and television thar ollustrate problems with that side of the arguement too